Everybody says that raising money for your startup will take longer than you think it will, will be be harder than you think it should be, will be more of a pain in the ass than anything you’ve done before.

They’re right.

But now that we’ve gone through it, I can say this: it’s also incredibly rewarding. And I mean more than just the obvious reward of having a bunch of money in your bank. The fundraising process is an opportunity to explore your business, your team, and, really, yourself, with some of the smartest people in the world. Investors, especially angels who are ex-entrepreneurs themselves, have a vast array of experiences and knowledge to draw from. If you’re raising money now and not paying attention to what potential investors are saying to you, then let me say this to you: You Are Fucking This Up.

But I’m getting ahead of myself. I wanted to write this to share what the Keen experience was like during our fundraising process. And hopefully our thought process as well. So let me try to do that.

As you may or may not already know (depends on if you know us / have read this blog before), we graduated from the TechStars Cloud program in mid-April. One of the big benefits (among many, many others) of doing TechStars is having the opportunity to pitch your business to a room full of the best investors in the world at the conclusion of the program. We took this opportunity seriously and worked really hard on our pitch.

But our efforts at raising money began before Demo Day even happened. We started reaching out to investors about a month prior to the Big Day. And to our relief (and, let’s be honest, a little bit of surprise), we found out there was a lot of interest! Rather than focusing entirely on whether or not people would be interested in investing, we got to start thinking about other questions, like how much should we actually raise? And since we suddenly had most of our round committed, we realized we could ask for more.

So we did for Demo Day. And our hard work paid off. Demo Day was a big explosion of publicity for us and gave us a structural advantage for starting our fundraising process.

And then we took the show on the road.

With the momentum of an amazing Demo Day pitch behind us, things got crazier. Within two days of moving back to San Francisco, we’d attracted a couple more Bay Area investors.

Then we took what was intended to be a quick decompressing vacation to Portland (to see Jeff Mangum!) and Seattle. It turned out to be one of my favorite road trips, ever.

As we were driving, Kyle took calls from the backseat. We all cheered when the first call with an investor went really well. Then he got an email “Is there any room left in your round for me to invest?”. And we cheered at that. Then he took another investor call, and we cheered after that. Then he got another email. And another one. I remember turning to Michelle and saying, “It’s not going to get any better than this”. It was a moment of real pleasure — watching all our hard work pay off, literally and figuratively.

(As an aside, I was totally wrong — it got even better.)

Kyle closed two investors during that drive and stoked interest in many more. We realized that we had an opportunity that few companies get — people wanted to put more money into Keen than we were asking for! Normally, making the decision to change the amount of money you want to raise as a company would take hours or days. We’re talking about serious amounts of money and serious amounts of equity.

We did it differently.

We talked for two or three minutes about it, texted Ryan (our third co-founder) to make sure he was on board, and decided. This ability to be so agile is why startups are awesome, by the way. If you’re thinking about starting one or joining one, Just Do It.

We had a great time in Portland and Seattle. But when we got back, the work really started.

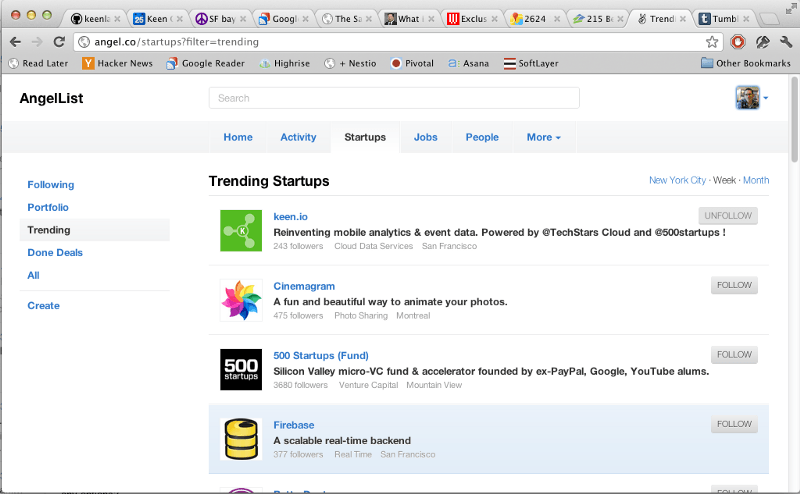

Our first priority was to increase visibility to the investor community. The more interest there was in Keen, the pickier we could be about who we picked as investors. Since we already had a good amount of our round committed, we felt like we could really take advantage of AngelList. We set ourselves the goal of becoming the #1 trending startup on the site (you get emailed out to the entire AngelList community if that happens). We picked a date and sent out notes to our entire community of co-founders, co-entrepreneurs, investors, friends, and family, asking them to comment, like, and share us with their followers on AngelList.

And slowly but surely we moved up the charts. The team celebrated when we cracked the top 10. When we hit top 5 we broke out beers. Then we hit top 3 and had to leave our computers to go to a party we had already committed to. During the party, Kyle came over to where I was sitting and asked me for a hug. If you know us, you’ll know that’s not really that weird, but as I stood up he told me we hit number 1.

That was an awesome night.

We really did have an explosion of interest after that. It seemed like for every investor we met with, two more introductions would pop up. Kyle handled most of the legwork of being point of contact for all these potential investors, only bringing Ryan and me in when we needed to close someone. Our job quickly shifted. Instead of being worried about drumming up enough investor interest, we started to realize we could instead try and optimize the things we actually cared about.

And that’s when it got hard.

You have to realize something about the three of us — we’re all big gamers. And we’re analytical. And competitive. We play those really complicated strategy board games that are supposed to take an hour or two to finish. They take us four or five hours. We just can’t help thinking through every possible move, every possible outcome and side-effect of those moves, and how best to take advantage of a given situation.

So how does this apply to raising money at a startup? Let me list a bunch of variables you can tweak when putting together a round:

- Vehicle. Are you raising a priced round, a convertible note, or something else?

- Amount. How much money do you actually want to bring in?

- Price. How much equity are you giving up (or will potentially give up if you’re doing a note) to bring in that money?

- Control. Are you going to put any investors on your board?

- Form of control. What’s your board going to look like? Is it a 1–1–1? A 2–2–1? Who will be on the board from the company, who will be on the board from the investors, and who will be your “independent” member?

- Form of stock. Are your investors getting preferred? Participating? Both? What’s the liquidation preference? Do yourself a favor here and read Venture Deals if you haven’t.

- Convertible note details. What’s the cap? Is there a discount? Does the investor get BOTH the cap and the discount on a conversion or just one?

- Information rights. How often do you need to share finances with your investors? And do they have to invest above a certain amount to get this right?

- And finally, but certainly not least: who are your investors going to be? Are they going to be dumb money or value-add? Are they culture fits? Do they understand your space? Can they help get you to a new one? How much time are they going to dedicate to you? This is just as important as hiring co-workers.

Can you imagine how crippling all this was for us? We agonize for hours over how to spend ability points in games. Decisions that literally have no real-world effects are painstakingly analyzed. Suddenly we were faced with decisions that were more complicated, more in-depth, and WAY MORE IMPORTANT.

Like I said before, it was hard.

In the end, we decided on a single guiding principle to help shape our decisions. If doing something now would allow us to make better-informed decisions in the future, that was good.

Let me explain.

As I alluded to before, the greatest ability of a startup is to be agile. Part of being agile is being able to respond, quickly, to new information as it comes in. So any time we can defer a decision that doesn’t need to be made today, that means we can decide later… when presumably we’ll have more information to make a better-informed decision.

Think back to the gaming analogy. To be good at any game, you have to be able to think many steps ahead, while still planning for all contingencies. If there’s something you can do to give yourself insight into how future turns will play out, it’s almost always a good idea. We take the same approach to business decisions. We don’t shy away from making hard ones, but if there’s no structural reason to make a decision today when we could know more tomorrow and make a better decision, we’ll do that.

That’s one of the reasons we did a convertible note. Aside from being less paperwork and cheaper, it doesn’t tie our hands with respect to future financings. If we wanted to, we could go raise more money right now (since each note is its own self-contained deal). That wouldn’t be the case if we did a priced round. We also get to make a decision on price later, presumably when we’re more valuable.

That’s why we didn’t give up a board seat. Nobody demanded it of us, so we’ll make that decision later if and when we raise another round.

And most importantly, we optimized on people, not on price. We definitely could have increased our cap. But we wanted to get as many high quality people involved as possible. We got addicted to the high quality mentorship given to us at TechStars. This goes back to the point I made at the beginning of this post. Our whole team is made up of learners. What better way to learn than to surround yourself with a group of incredibly smart, incredibly experienced, and incredibly supportive people? People who can point out glaringly obvious facts about your business (that you might have missed)? People who have deep connections in the industry? People you’d love to get a drink with, talk strategy with, or play a complicated board game with (see: Dirk Elmendorf)?

That’s exactly what we did. And so I’m very happy to announce that we’ve closed our seed round. Our investors are 500 Startups, Data Collective, SK Ventures, Galvanize, Cloud Power (a San-Antonio-based fund set up for our TechStars class), and a range of angel investors with broad experiences as entrepreneurs (with successful exits and at some of the biggest names in tech: Rackspace, Twitter, Cisco, Google, Zynga, RedHat, PayPal, and more) and successful investors. I can’t tell you how excited we are to partner with all of our new investors. And let’s not forget our old investors: TechStars! We wouldn’t be here today without them.

Let me leave you with this: the first thing you should do when raising a round is to figure out what’s important to you. The only constant in raising is that, if you’re successful, you have some more money at the end. Everything else is the interesting part. There are a multitude of investment options available (assuming you can get interest). It’s essential to know what you want to get out of the experience aside from capital. Once you’ve got that worked out, everything else will fall into place nicely.

Oh, and let us know if we can help. The only way we were successful was by taking the advice of people who’ve done this before. We’re happy to pay it forward in any way we can. Get in touch with us at team@keen.io or check us out on twitter!

-Dan